The principles of technical analysis are derived from hundreds of years of financial market data. Some aspects of technical analysis began to appear in Joseph de la Vega's accounts of the Dutch markets in the 17th century. In Asia, technical analysis is said to be a method developed by Homma Munehisa during early 18th century which evolved into the use of candlestick techniques, and is today a technical analysis charting tool. In the 1920s and 1930s Richard W. Schabacker published several books which continued the work of Charles Dow and William Peter Hamilton in their books Stock Market Theory and Practice and Technical Market Analysis. In 1948 Robert D. Edwards and John Magee published Technical Analysis of Stock Trends which is widely considered to be one of the seminal works of the discipline. It is exclusively concerned with trend analysis and chart patterns and remains in use to the present. Early technical analysis was almost exclusively the analysis of charts, because the processing power of computers was not available for the modern degree of statistical analysis. Charles Dow reportedly originated a form of point and figure chart analysis.

Dow theory is based on the collected writings of Dow Jones co-founder and editor Charles Dow, and inspired the use and development of modern technical analysis at the end of the 19th century. Other pioneers of analysis techniques include Ralph Nelson Elliott, William Delbert Gann and Richard Wyckoff who developed their respective techniques in the early 20th century. More technical tools and theories have been developed and enhanced in recent decades, with an increasing emphasis on computer-assisted techniques using specially designed computer software.

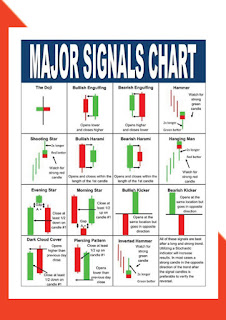

Technicians using charts search for archetypal price chart patterns, such as the well-known head and shoulders or double top/bottom reversal patterns, study technical indicators, moving averages, and look for forms such as lines of support, resistance, channels, and more obscure formations such as flags, pennants, balance days and cup and handle patterns.

There are many techniques in technical analysis. Adherents of different techniques (for example, candlestick charting, Dow theory, and Elliott wave theory) may ignore the other approaches, yet many traders combine elements from more than one technique. Some technical analysts use subjective judgment to decide which pattern(s) a particular instrument reflects at a given time and what the interpretation of that pattern should be. Others employ a strictly mechanical or systematic approach to pattern identification and interpretation.

A fundamental principle of technical analysis is that a market's price reflects all relevant information, so their analysis looks at the history of a security's trading pattern rather than external drivers such as economic, fundamental and news events. Therefore, price action tends to repeat itself due to investors collectively tending toward patterned behavior – hence technical analysis focuses on identifiable trends and conditions

Concepts Should be well Versed

•

Average true range – averaged daily trading range, adjusted for price gaps.

•

Breakout – the concept whereby prices forcefully penetrate an area of prior support or resistance, usually, but not always, accompanied by an increase in volume.

•

Chart pattern – distinctive pattern created by the movement of security prices on a chart

•

Cycles – time targets for potential change in price action (price only moves up, down, or sideways)

•

Dead cat bounce – the phenomenon whereby a spectacular decline in the price of a stock is immediately followed by a moderate and temporary rise before resuming its downward movement

•

Elliott wave principle and the golden ratio to calculate successive price movements and retracements

•

Fibonacci ratios – used as a guide to determine support and resistance

•

Momentum – the rate of price change

•

Point and figure analysis – A priced-based analytical approach employing numerical filters which may incorporate time references, though ignores time entirely in its construction

•

Resistance – a price level that may prompt a net increase of selling activity

•

Support – a price level that may prompt a net increase of buying activity

•

Trending – the phenomenon by which price movement tends to persist in one direction for an extended period of time

Types of charts KNOWN

•

Candlestick chart – Of Japanese origin and similar to OHLC, candlesticks widen and fill the interval between the open and close prices to emphasize the open/close relationship. In the West, often black or red candle bodies represent a close lower than the open, while white, green or blue candles represent a close higher than the open price.

•

Line chart – Connects the closing price values with line segments.

•

Open-high-low-close chart – OHLC charts, also known as bar charts, plot the span between the high and low prices of a trading period as a vertical line segment at the trading time, and the open and close prices with horizontal tick marks on the range line, usually a tick to the left for the open price and a tick to the right for the closing price.

•

Point and figure chart – a chart type employing numerical filters with only passing references to time, and which ignores time entirely in its construction.

Overlays are generally superimposed over the main price chart

•

Bollinger bands – a range of price volatility

•

Channel – a pair of parallel trend lines

•

Ichimoku kinko hyo – a moving average-based system that factors in time and the average point between a candle's high and low

•

Moving average – an average over a window of time before and after a given time point that is repeated at each time point in the given chart. A moving average can be thought of as a kind of dynamic trend-line.

•

Parabolic SAR – Wilder's trailing stop based on prices tending to stay within a parabolic curve during a strong trend

•

Pivot point – derived by calculating the numerical average of a particular currency's or stock's high, low and closing prices

•

Resistance – a price level that may act as a ceiling above price

•

Support – a price level that may act as a floor below price

•

Trend line – a sloping line described by at least two peaks or two troughs

•

Zig Zag – This chart overlay that shows filtered price movements that are greater than a given percentage.